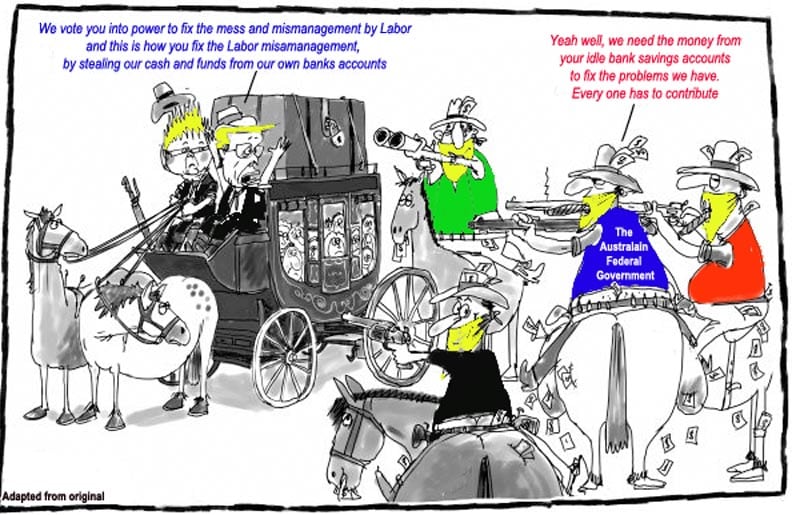

Peter Adamis 10 June 2014. If the articles below are to be believed then we as Australians have a serious with our Federal Government and the manner in which they treat those they are supposed to protect and look after their citizens. problem on our hands. I am of the belief that there should be consultation, communication and the greatest of efforts made to those who the money rightly belongs to. A compete copy of the article may be downloaded by clicking on: ARE IDLE HOUSEHOLD BANK ACCOUNTS SEIZED BY AUSTRALIAN FEDERAL GOVERNMENT WITHOUT NOTICE

Peter Adamis 10 June 2014. If the articles below are to be believed then we as Australians have a serious with our Federal Government and the manner in which they treat those they are supposed to protect and look after their citizens. problem on our hands. I am of the belief that there should be consultation, communication and the greatest of efforts made to those who the money rightly belongs to. A compete copy of the article may be downloaded by clicking on: ARE IDLE HOUSEHOLD BANK ACCOUNTS SEIZED BY AUSTRALIAN FEDERAL GOVERNMENT WITHOUT NOTICE

If it’s a grandparent, parent investor and/or the mum and dads who have funds left in the bank for a rainy day, the Australian Government has no right to those funds. This is downright stealing and theft at the highest level and all Australians should be questioning this underhanded behaviour f our government.

My advice is that if you are not sure or that you are concerned, contact your bank and enquire about any funds that have been sitting idle with the bank for any amount of years. Without sounding alarmist, it’s better to be in the know than to be sorry. If you are affected by any of these underhanded methods by stealth, check with your bank and/.or visit the quick, free searches for lost money on ASIC’s MoneySmart website. Visit ASIC’s MoneySmart website at url: https://www.moneysmart.gov.au/

One hopes that this is a hoax, but something tells me that something is amiss and that the Federal Government is obtaining funds by deception. One hope that is not true, but it certainly deserves some looking into. Readers can make their own minds up based on the recent articles displayed below.

![]() The Voice from the Pavement – Peter Adamis is a Journalist/Commentator and writer. He is a retired Australian military serviceman and an Industry organisational & Occupational (OHS) & Training Consultant whose interests are within the parameters of domestic and international political spectrum. He is an avid blogger and contributes to domestic and international community news media outlets as well as to local and Ethnic News. He holds a Bachelor of Adult Learning & Development (Monash), Grad Dip Occupational Health & Safety, (Monash), Dip. Training & Assessment, Dip Public Administration, and Dip Frontline Management. Contact via Email: [email protected] or via Mobile: 0409965538

The Voice from the Pavement – Peter Adamis is a Journalist/Commentator and writer. He is a retired Australian military serviceman and an Industry organisational & Occupational (OHS) & Training Consultant whose interests are within the parameters of domestic and international political spectrum. He is an avid blogger and contributes to domestic and international community news media outlets as well as to local and Ethnic News. He holds a Bachelor of Adult Learning & Development (Monash), Grad Dip Occupational Health & Safety, (Monash), Dip. Training & Assessment, Dip Public Administration, and Dip Frontline Management. Contact via Email: [email protected] or via Mobile: 0409965538

GOVT SEIZES $360M FROM IDLE ACCOUNTS

AAP 10 JUNE 2014

The federal government has seized a record $360 million from household bank accounts that have been dormant for just three years, prompting outrage in some quarters amid complaints that pensioners and retirees have lost deposits.

Figures from the Australian Security and Investments Commission (ASIC) show almost $360 million was collected from 80,000 inactive accounts in the year to May under new rules introduced by Labor.

The new rules lowered the threshold at which the government is allowed to snatch funds from accounts that remain idle from seven years to three years. The rule change has delivered the government a massive bonanza with the money collected in the year to May more than the total collected in the past five decades combined. Between 1959 and 2012, the total collected was $330 million.

While the purpose of the laws is actually to reunite people with lost accounts before funds are eroded by fees and other charges, the lower threshold has been criticised as a budget cash-grab which affected accounts that were neither lost or forgotten.

Australian Bankers’ Association chief executive Steven Munchenberg said the legislation was a “rushed” budget-boosting exercise which had transferred money set aside by people for their grandchildren’s future to the government’s coffers. Visit ASIC’s MoneySmart website at url: https://www.moneysmart.gov.au/

“We have grandparents who put money aside for their grandkids’ future and farmers who have set aside money for a rainy day, but it was transferred to the government,” Mr Munchenberg told Fairfax Media. Ninety per cent of the accounts seized by the government had balances of less than $5000, although some were worth millions.

https://www.businessspectator.com.au/news/2014/6/10/politics/govt-seizes-360m-idle-accounts

PENSIONERS LOSE SAVINGS IN GOVERNMENT CASH GRAB

June 10, 2014 Esther Han, Inga Ting

The federal government has bagged an unprecedented $360 million from household bank accounts since a controversial change to unclaimed money laws, figures from the Australian Securities and Investments Commission show.

Pensioners and others saving for a rainy day have reported trying to access their savings only to discover their money had been seized by the government because it had been dormant for three years or more.

The government has collected more money from inactive bank accounts under the three-year rule than the total amount captured in the past five decades combined.

When government takes your money, literally

The government takes away Kim Taylor’s money from her bank account because she hadn’t touched it in more than three years. Nearly $360 million from 80,000 accounts was funnelled into government coffers in the year to May after Labor lowered the threshold, eclipsing the $330 million netted between 1959 and 2012, during which time idle accounts could only be touched after seven years.

The Treasury now looks poised to raise the threshold in the face of fierce lobbying from the banking industry, with Finance Minister Mathias Cormann releasing a discussion paper on changing the definition of inactivity from three years to five. Such a change would halve the number of inactive accounts taken by the government each year, he said. “These changes caused substantial disruption to account holders … and to industry, with businesses forced to rapidly implement new and costly systems. We want to reduce the regulatory burden of these laws.”

“We have grandparents who put money aside for their grandkids’ future … but it was transferred to the government”: Steven Munchenberg. Photo: Justin McManus

Australian Bankers’ Association chief executive Steven Munchenberg said the legislation was a “rushed” budget-boosting exercise that angered customers whose accounts were in fact not lost or forgotten. “We have grandparents who put money aside for their grandkids’ future … and farmers who have set aside money for a rainy day, but it was transferred to the government,” he said.

He dismissed suggestions the banks wanted to reduce the flow of money to shore up their revenue. “To you or I, hundreds of millions of dollars might be a lot of money, but when you’re looking at the funding level of banks, it’s all trivial.” But consumer group Choice said it supported the three-year provision because high bank fees could “eat away” at inactive accounts.

“Extending the period of time unclaimed money could remain in an inactive account … is not in a consumer’s best interests. Missing money shouldn’t be whittled away by industry through penalties and fees,” said spokesman Tom Godfrey. ASIC said the chief purpose of the laws was to reunite people with lost accounts before funds were eroded by fees, charges and inflation. It refused to detail how much had been successfully claimed in the past year, but in 2012 ASIC returned $62 million, of which $33 million was from inactive bank accounts.

Kim Taylor, a marketing consultant from Randwick, deposited a few thousand dollars into an ING account with the intention of leaving it aside and letting it accumulate interest. Now the balance sits at zero. ”I wanted the money to sit there as a maternity leave thing. I left it there thinking that’s my little luxury nest egg. I have four children under the age of nine, and I work full-time; getting the paperwork sorted to get the money back has been painful.”

Connie Franze, 68, and her son Vince, 45, are trying to reclaim their life savings of more than $12,000 that was taken by the government last June. ”I saved for 45 years … It was my carer’s pension and his disability pension,” said the retiree from Hurstville. Ms Franze opened the Commonwealth Bank account 45 years ago, squirrelling away a small portion of her $50-a-week earnings from growing and selling plants. The pair were saving for a trip to Italy to visit her mother.

”She was 100 years old. I wanted to take money out. They wouldn’t give me the money [and then] my mother died this year. The last time I saw her was 20 years ago.” Last Wednesday, Edward Manning, 62 of Oakdale, reclaimed a “substantial” sum that had been transferred to the government in March. The Citibank account held his inheritance. “For two months we had to draw back on our mortgage and the mortgage has increased It was frustrating,” he said.

The amounts seized from individual accounts range from a few cents to close to $2 million, although more than 90 per cent are worth less than $5000. Nine accounts, all seized in June last year, were worth more than $1 million each. One woman from Caulfield, Victoria, has lost nearly $5 million across five different accounts. The public can conduct quick, free searches for lost money on ASIC’s MoneySmart website. It can scoop up records of unclaimed money from bank accounts, life insurance policies and company shares. Visit ASIC’s MoneySmart website at url: https://www.moneysmart.gov.au/

If you find money that is yours, approach the bank to have the claim verified. The bank will notify ASIC. Owners are paid interest on lost money based on the percentage change in the Consumer Price Index, payable from July 1 last year. No tax has to be paid on the interest earned.

http://www.smh.com.au/federal-politics/political-news/pensioners-lose-savings-in-government-cash-grab-20140609-39t7p.html